![]()

![]()

Do You Need to Update Your Estate Plan?

Here's How to Find Out...

A LOT Happens in a Year!

Download your

FREE Estate Plan Checkup below!

If you have had a major life change, it’s time to review your plan to see if it still aligns with your life now. Let us take a look. We will let you know if your plan is good to go or if you need to make some changes to keep things in order.

START YOUR ESTATE PLAN REVIEW

Take a Moment to Reflect…

Think back for a moment – think of all the changes in your life over the past year (or more). What’s changed since you signed your will, trust, and other estate planning documents? If something has changed that affects you, your trusted helpers, or your beneficiaries, your estate plan probably needs to reflect that change.

Here are examples of changes that are significant enough to warrant an estate plan review and, likely, updates:

A Birth

An Adoption

A Marriage

A Divorce or separation

A Death

Addictions

Incapacity/disability

Health challenges

Any Financial status changes – good or bad

Tax law changes (!!)

Moving to a new state

Change in Family circumstances – for good or bad

Change in Business circumstances – for good or bad

Obviously, you should do due diligence without spending inordinate amounts of time noodling over your plan. To that end, ask yourself the following “stress test” questions to assess whether you need to meet with an estate planning attorney to update your approach:

Your Estate Plan “Stress Test”

-

-

-

When was the last time you updated your will or living trust? Has life changed? Had a child? Divorced? Moved to a new state? Opened or sold a business? Or, just changed your mind about the type of legacy you want to leave behind? If big life events have occurred, strongly consider updating your plan as soon as possible. Also, keep in mind that there may have been changes in the law since your last update that could significantly affect your plan.

-

-

-

-

-

Who have you named as executor and trustee? If you had to start your planning over from scratch today, would you still name the same people? If not, why not? Did you choose the best person for the job or was your choice based on less relevant factors? Is the person you chose still available to serve in that role?

-

-

-

-

-

Do you have adequate insurance? Many people do not have enough insurance for themselves or their businesses. They also fail to name contingent beneficiaries. Get your insurance policies in order, and make sure your designations match your estate plan.

-

-

-

-

-

How much of your property is jointly owned with someone other than your spouse? Jointly owned property has the potential to be double taxed. Take a look at your real property and seek advice on the proper adjustments to make in order to save on taxes when it’s really necessary to save on taxes.

-

-

-

-

-

How’s your record keeping? Nothing drives an executor crazy like sloppy record keeping. Not only that, but sloppy record keeping will drive up the cost of your estate’s final administration cost – keeping precious dollars out of your beneficiaries and heirs hands.

-

-

-

-

-

When was the last time you gave your plan a thorough once-over? Even if nothing “huge” has happened in your life recently, if it’s been over three years since a qualified estate planning attorney has assessed your strategy, schedule a time to meet.

-

-

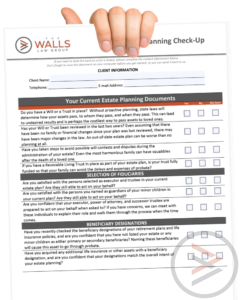

We’ve included an in-depth downloadable checklist for you to use to find out if you need to update your plan.

FREE DOWNLOAD

If you’d prefer to download a PDF copy of the checklist to print out, you can download it here!![]()

OR REVIEW YOUR PLAN ONLINE USING OUR ONLINE REVIEW TOOL!

If you have had a major life change, it’s time to review your plan to see if it still aligns with your life now. Let us take a look. We will let you know if your plan is good to go or if you need to make some changes to keep things in order.