What is Asset Alignment?

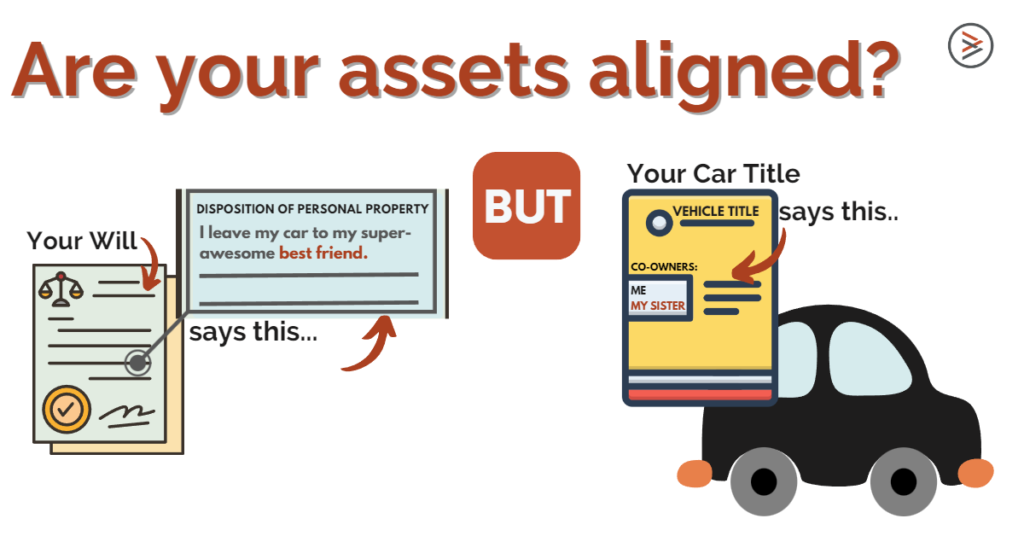

Assets must be aligned with your Trust or Will to keep them out of Probate court and accomplish the many things they are designed to do.

This legal strategy is called “Asset Alignment” (also known as the “funding” of a trust).

Asset alignment ensures that all your assets and named beneficiaries align across all areas of your estate plan.

Establishing a trust is a great first step toward planning for your future and protecting your family. However, if you haven’t taken the step to have your assets aligned, it may be as good as having done nothing at all.

When you obtain new assets throughout your lifetime (and sometimes sell or dispose of them), you need to ‘align’ them with your Trust or Will – or they will be left our of your plan.

Here’s an example: a life insurance policy names two daughters as beneficiaries. The father didn’t want them to have access to these funds until they turned 30, but he forgot to add that policy to his estate plan, so the policy was never ‘aligned with’ the Will or Trust. When the father dies, the girls have immediate access to the money. And there’s no way to protect the funds from a divorce or being accessed by creditors.

Ensuring that your Assets are Aligned with your Estate Plan is one of the most important things you can do once you establish your Plan.

It’s also really important to UPDATE YOUR PLAN periodically.

Your assets and situations change over time. It’s wise to review and update your estate plan every 3-5 years. Life gets busy to we’ve found it’s a good idea to set aside time after each new year to reflect on the changes to your life over the prior year.

Births and deaths in your family may affect who you want to receive your assets. In addition, a change in your net worth or the tax law may necessitate altering your plan.

Once you’ve fully aligned your assets, it’s important to review your estate plan every two to three years.

How to Align Your Assets?

When you purchase or otherwise obtain a new asset (like a new vehicle, real property, or other financial asset), you need to be sure that the ownership of that asset (or beneficiary designation) is updated to align with your estate plan.

Sometimes this means updating the title or deed to be in the name of the Trust instead of your own (ie. Owner Name: “Jane Doe, Trustee of the Jane Doe Trust,” as opposed to just “Jane Doe”). For assets such as life insurance and retirement accounts, you will need to change to the name of your beneficiaries, not necessarily to the name of the Trust. If you don’t take this step, that asset is owned by you, personally – not by your estate, therefore not aligned with your estate plan and will consequently be handled by your Probate Estate instead of managed the way you set your estate plan up. In other words, that asset will be included in Probate, and subject to probate court fees and held up in the Probate process until which time it can be (at a cost), properly re-assigned to its new owner.

Always be sure that any new assets you want to be included in your Trust or Estate Plan are properly aligned with your plan as soon as possible. Whether that means including someone else’s name on a deed, retitling ownership into the name of your Trust, or even something as simple as setting up the POD (payable on death) designations on financial accounts.

Is it time for you to review your estate plan to check for out-of-date wishes or other issues? We’ve made it easy for you to check your plan! Use our Online Estate Plan Self-Audit Review Tool or Download your Estate Plan Checklist to print and go through later.

Give us a Call if you Need Help Aligning Your Assets

Keeping your Assets Aligned with your Estate Plan is vitally important.

We offer our services to assist you with the transfer of titles, deeds, and other accounts.

Give us a call if you need help!

We’d love to hear from you!

- 5 Must-Have Elements in Your Raleigh Kids Protection Plan

- Wake County Probate Guide: What Raleigh Families Need to Know

- Guardianship 101: Protecting Your Loved Ones

- How to Recover Surplus Funds Legally—Without Paying Excessive Fees

- When Love Means Legal Protection – Understanding Guardianship

- Handling a Loved One’s Estate – What to Expect & How to Prepare

- Blog Posts Page Template

- Love your Business – Planning for Long Term Success

- What to do when you get divorced (a checklist!)

- Celebrity Estates: Jay & Mavis Leno

- A ‘Mean Girls’ Guide to Estate Planning

- Can I handwrite my last will?

- 4 Reasons to Tackle Your Estate Planning Today (Infographic)

- Has an Investor or “Finder” Contacted You to Help You Claim Your Surplus Funds? (If so, READ THIS FIRST!)

- SCAM ALERT: Deceptive Annual Report Notice Circulating

- What To Do When A Loved One Dies

- Jason Walls Inducted in Business NC Legal Elite Hall of Fame

- WRAL Voters’ Choice Awards 2022

- What is Asset Alignment?

- Do You Need to Review Your Estate Plan? (Estate Plan Review Checklist)